Christmas excites everyone! If kids are looking forward for the holidays because of the toys and gifts; most Filipino workers are on the lookout for the 13th month pay.

Let’s admit it, Christmas won’t be merry without the 13th month pay. It is the time of year when one feels an increase in spending power. But hep, hep! Before you ran off and splurge your hard-earned bonus, check out the these 5 IDEAS on maximizing your peso guilt-free. I understand that some of you might have received the year-end bonus as early as November, but I am still hoping that this article is not too late 🙂

- Paid Off Debts – 30% of my 13-month

Wouldn’t be nice to welcome 2018 debt-free? Good thing, I only have few but a bit huge (monthly amortization/equity for the acquired property). I’m a type of person who is allergic to “utang”. So I see to it that I put a portion of my bonus settling my due. Debts, by the way, includes credit card balances, personal loans, amortization or even the cash borrowed from family, friends or colleagues. If you have a number of financial obligations to settle, I suggest prioritize those that have high interest rates (i.e. credit cards!). You do not want to end up paying more on interest than the principal.

I had 3 credit cards but have to cancel ALL after settling all my balances. I felt that I’m living beyond my means. Credit cards are a big NO for compulsive buyers.

Just a little tip – if you own one, leave the credit card (and even your ATM) at home. Just bring enough cash when you go to school or office. This will prevent you from spending too much and at the same time a good alibi if a friend/colleague approaches you to borrow some cash. “I am sorry friend. Hindi kasi ako nag-withdraw eh saka hindi ko dala ATM/Credit Card. Nag try ka na kay *****?” – this has been my spiel since I became budget-conscious.

2. Invested in stocks/mutual funds – 30% of my 13-month

Do you know that you can invest in stocks with Php5000.00 as start up? I have been looking for ways to invest. I have tried a couple of insurance providers before. I immediately canceled the life insurance plan I got from Family First even before I start paying for the monthly premium. But I the educational plan I got from Prudential Plans was fully paid. Unfortunately, both insurance providers closed down!

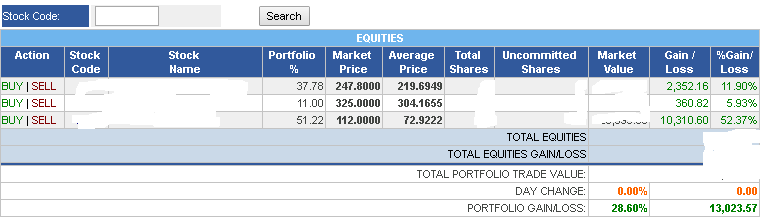

It was late months of 2014 when I became curious about the stock market. I researched, I asked around and consulted colleagues/friends who work on financial field. Then, December 2014, I decided to join the trading via COLFinancial (naks!). I put a portion of my salary every two months – at first. And eventually forgetting about it, lol. Then, after months of not checking my account online, I decided to take a peek and was surprised to see 28.60% gain! That’s around Php13k gain on my portfolio!

If our SAVINGS are the financial protection for the present; then INVESTMENTS are for the future. If you are one of those who dreams to earn from a passive income- then stocks and mutual funds are the answer. Passive income is when you exert minimal work to earn money- it is making your money work for you. You do not even have to be an expert on stock market to earn from these. There are fund managers and financial institutions you can turn to.

Another little tip – if you are looking for a long-term investment, then go for the blue chip stocks. These are the shares from well-established and financially sound companies that have demonstrated their ability to pay dividends in both good and bad times . (Source: PSE Academy). I also opened a mutual fund (BDO’s UITF) almost the same time when I opened my ColFinancial. I recently closed it (November 2017) because it did not earn as much as the stocks. And also I have to prioritize my monthly amortization.

3. Built an Emergency Fund- 20% of my 13-month

I recently opened another savings account from s different bank in case of emergency and urgent needs. I repeat, urgent and emergency- it does not pertain to emergency sale or flash sales sa malls. Hahaha. I opted to have it on a different bank so I will not be tempted to transfer funds/money (either via ATM or online banking) from time to time and easily withdraw it afterwards to satisfy my shopping or retail itch.

The emergency fund can protect you financially for any unforeseen events like healthcare expenses, home repairs, and even job loss or retrenchment. You do not have to allocate your full 13th month for the emergency. Just a portion of it will help you get started. Then built a habit of depositing even a small percentage of your future salary until you have reached/surpass your goal.

4) Invested to Earn from a Hobby or Passion- 10% of my 13-month

Can your hobby make you money? If your answer is a resounding YES, start investing on it. The best ways to earn actually lie in our hobbies, whether we realize it or not. After all, it does not feel like a job if you love what you are doing.

If you are a content writer, graphic artist, web designer and love to blog, you can invest in a brand-new laptop that can help you work from anywhere. You can also enroll in some training classes and seminars that will further enhance your skills. Whether it is a new gadget, appliance or certification, as long as it can help you earn money and improve on your expertise, then it is a smart way to allocate portion of your 13th month on your hobby and passion.

5) Bought Gifts for My Loved Ones- 10% of my 13-month

Be a Santa Claus to family and friends! You are more blessed to be a blessing to others. Share what you have and it will come back to you a thousand folds. O, heto na nga, sa panahon ngayon, maging wais at praktikal. If there is sale, go for it. But if none, wag natin ipilit ang malls. Mall prices are too expensive compared to the items we see sa mga tiangge and ukay-ukay even if quality is basically the same (there may be some na slight lang ang difference). Remember, what make mall prices so high is its location, the ambiance, the environment. There are a lot of ways and means to warm hearts this Christmas season without spending a fortune.

Half of the Christmas gifts that I bought were from SM Outlet store in Quiapo, and some from Divi La Rue (a.k.a Divisoria). I was able to score 3 pairs of sneakers for kids for Php500 TOTAL! The quality, style and design amazed me so much that I decided to go back to buy a couple more this coming Saturday. There were also toys I hoarded when Toy Kingdom had a warehouse sale few weeks ago. For parents – based on my experience, they prefer accepting money instead of any fancy gifts. So I allotted some of my bonus to them as Christmas presents plus 2 pairs of earrings for my Nanay and a couple of sandals for my Tatay- both purchased from Lazada during the Online Revolution. Total cost? Php490.00 only!

For my titos/titas, I was actually planning to take advantage of Lazada‘s 99 Pesos Deal during their Online Revolution. Unfortunately, it is NOT just 99 Pesos pala, it is also GONE in 99 Seconds! The items were already on my shopping cart and everything disappeared as soon as hit CHECKOUT! So I still have my titos/titas on my gift list.

If you are still looking for that perfect deal on bags, shoes, apparel or other essentials? Search Lazada Store and take advantage of massive discount! Free Shipping, Cash on Delivery, Free Return– a truly Effortless Shopping Experience!

Type an item on the box and hit ENTER.

Ayan, I hope this helps! Christmas is giving, so don’t hesitate to express your love in a very simple way. Don’t say good bye too fast to your 13th month pay! May bukas pa! Enjoy the Holidays, Guys!