New year, new start! Pag-IBIG MP2 (Modified Pag-IBIG II) Savings is your perfect game plan to save money!

In case you missed it, Pag-IBIG Fund has recently reported that its MP2 savings program has reached a record high of PHP 52 billion during the last 10 months, breaking yet another record with a 35% growth from the same period in 2020.

As the pandemic continually hits the nation, now is the perfect time to think about ways to improve our savings. With its nearly 7% interest, beating most bank rates, we should seriously consider Pag-IBIG MP2 Savings Program to grow our hard-earned money.

This article contains everything you need to know about Pag-IBIG MP2 Savings Program and why it is an investment worth considering.

UPDATE: MP2 DIVIDEND RATES as of YEAR 2023

What is Pag-IBIG MP2?

MP2, or Modified Pag-IBIG II, is an optional savings program for current and past Pag-IBIG Fund members who want to expand their savings in addition to their monthly Pag-IBIG contributions.

Pag-IBIG MP2 Key Features and Benefits.

- Government-guaranteed and tax-free earnings

It is a government fully-guaranteed program, giving you peace of mind and removing the chance of losing your money. Aside from that, all of your returns are tax-free, making this a great option for cautious investors looking for a safe location to invest without risking their funds.

- Budget-friendly investment

You can invest for as little as PHP 500 per month. There are no penalties if you miss a contribution for a few months (but it’s ideal to make your MP2 contributions on a regular basis).

-

There are no fees and charges.

Unlike mutual funds, which have a sales load and other costs, your investment remains intact. You can choose to receive your MP2 dividends every year or every five years, with no tax deductions.

-

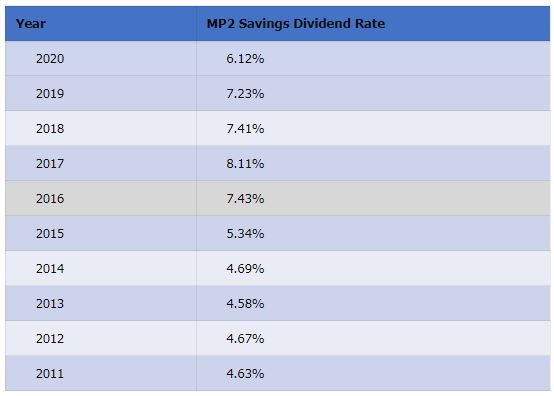

Higher annual dividend rates.

One of the most appealing features of an MP2 savings account is its consistent dividend rate history, which averaged 7.65 percent from 2016 to 2018, and 7.41 percent in 2019. This makes it more profitable than the ordinary Pag-IBIG savings program (P1), with payouts exceeding the average interest rates on most investment products offered by local commercial banks- savings, time deposits, and other investment vehicles.

-

Five-year maturity period.

Unlike other investment programs, which run between 10 and 20 years, the MP2 has a five-year maturity period, allowing you to access your money sooner. After that five-year period, you have the option of withdrawing your funds or allowing it to continue generating compounded interest for another cycle.

-

No Limit – on the amount you can save and number of MP2 savings account.

Put as much money as your budget permits into your MP2 account. A personal/check manager’s is necessary for one-time payments exceeding PHP 500,000.

You are free to create as many MP2 accounts as you want. This is perfect if you’re saving money for a variety of reasons, such as emergencies, tuition, travel, retirement, child’s education, or even for your small-business fund.

Who can save under MP2 Savings?

- The MP2 Savings is open to ALL active Pag-IBIG Fund members, regardless of their monthly income.

- Former Pag-IBIG members with other monthly income sources

- It is also open to former Pag-IBIG Fund members (pensioners and retirees) with other sources of monthly income, regardless of age, and with at least 24 monthly savings prior to retirement.

Inactive Pag-IBIG member? No worries! You can apply for Pag-IBIG MP2 by resuming their payments until they fulfill the minimum contribution requirement of 24 monthly contributions.

Not yet a member of the Pag-IBIG Fund? Before you can open an MP2 savings account, you must first register as a Pag-IBIG member and pay payments for at least 24 months. You can click HERE for online membership registration.

How to Apply for Pag-IBIG MP2?

You can enroll in the Pag-IBIG MP2 savings program in-person at a Pag-IBIG office OR open an MP2 Savings account safely and conveniently, online via Virtual Pag-IBIG. Once you are issued an MP2 Savings account number you can start saving!

Here are the steps to applying for the MP2 savings program online:

- Visit the Modified Pag-IBIG II Enrollment page at www.pagibigfundservices.com/MP2Enrollment.

- Enter your Pag-IBIG Membership ID (MID) number, last name, first name, and birth-date in required format (MM/DD/YYYY).

- Be sure to enter the CAPTCHA code before hitting the SUBMIT button.

- In the Desired Monthly Contribution field, enter the amount you wish to remit every month for your Pag-IBIG MP2 savings.

- Choose your preferred option from the following drop-down menus:

- Preferred Dividend Payout: Choose whether you want your MP2 dividends paid every year or at the end of the five-year period.

- Mode of Payment: Whether you choose to pay your MP2 contributions through salary deduction, over-the-counter at any Pag-IBIG branch, or through any Pag-IBIG Fund-accredited collection partners, there are options for you.

- Source of Funds: Your principal source of income, from which your MP2 payments will be made.

- Click the Submit button.

- Your completed Modified Pag-IBIG II Enrollment Form will be displayed, which contains your 12-digit MP2 account number. You may save this form as a PDF file or print it.

Here is the Manual Enrollment Procedure

Visit the nearest Pag-IBIG branch and submit the following documents for your MP2 application

-

- Valid ID

- Accomplished Modified Pag-IBIG II Enrollment Form

- ATM card or passbook of your bank account where you’d like to receive your MP2 savings and dividends

Where to Pay Pag-IBIG MP2 Contributions:

You can pay over-the counter through Pag-IBIG accredited payment centers or through their online payment channels. Some of these channels charge P5 processing fee per transaction. For payment via Pag-IBIG website, the fee is around P170 plus.

Over-the-Counter Payment Centers:

- SM Business Centers, including Savemore and SM Hypermarket bills payment counters.

- ECPay

- 7-Eleven

- M. Lhuillier

- Bayad Center

Online Payment Channels:

- Pag-IBIG Online Payment Facility

- Moneygment app

- Gcash

- Coins.ph

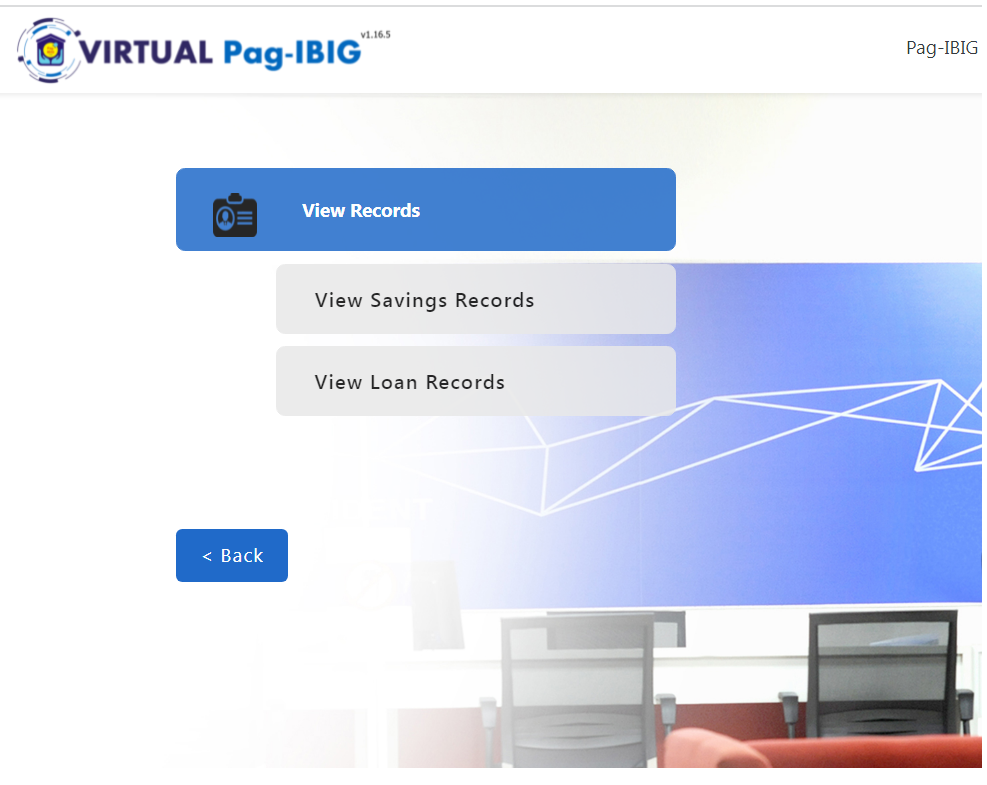

Monitor/Check Your Pag-IBIG MP2 Savings Online

You can use Virtual Pag-IBIG to keep track of your Pag-IBIG MP2 contributions. However, you must first create a Virtual Pag-IBIG account. Click HERE to register. You may currently verify your Pag-IBIG MP2 savings online after your Virtual Pag-IBIG account is enabled.

- Log in to your Virtual Pag-IBIG account.

- On the left menu, select “MP2 Savings” under the Products tab.

- View your Pag-IBIG MP2 contribution payments on the screen.

MORE FAQs ABOUT MP2 SAVINGS

- How much dividends will my MP2 Savings earn?

Your MP2 Savings earn annual dividends at a rate higher than the dividend rate of the Pag-IBIG Regular Savings Program.

Pag-IBIG Fund sets aside at least seventy percent (70%) of its annual net income and credits it proportionately to its members’ Pag-IBIG Savings as dividends. This means that the more you save, the higher dividends you shall earn.

In 2020, despite the challenges of the pandemic to our economy, the MP2 Savings earned a dividend rate of 6.12%.

- Where does Pag-IBIG Fund invest my money?

Pag-IBIG members’ MP2 contributions are put into Pag-IBIG housing loans (which generate interest from member-borrowers), government securities, and corporate bonds. The MP2 is a less hazardous investment than stocks and other high-risk instruments because it invests in fixed securities.

- When can I receive my MP2 Savings Dividends?

You can choose to receive your MP2 Dividends via the following options:

-

- Upon full withdrawal of your MP2 Savings after its 5-year maturity period with your MP2 Savings Dividends compounded annually;

-

- Through annual pay-out with your MP2 Savings Dividends credited to your savings or checking account enrolled in any of Pag-IBIG Fund’s accredited banks. For members who opt for annual dividend payout but have no Philippine bank account, such as in the case of overseas members, their MP2 Savings Dividends shall be released via check. Your principal MP2 Savings, meanwhile, shall be returned once it reaches its 5-year maturity.

- How will I receive my MP2 dividends?

Your MP2 dividends will be deposited into a Pag-IBIG Fund-accredited savings or checking account of your choice (e.g., DBP, LANDBANK, etc.). If you do not have a bank account in the Philippines, your MP2 dividends will be paid by checks if you do not have a

- Can I withdraw my MP2 savings before its maturity?

It’s preferable to just let the assets in your MP2 account grow until it matures, just like other investments. You will be able to enhance your revenues in this manner. However, an unforeseen life event may necessitate the withdrawal of your MP2 savings. The Pag-IBIG Fund allows for early withdrawal in the following circumstances:

-

- Total disability or insanity

- Termination from employment due to health reasons

- Death/Critical illness of the MP2 account holder or an immediate family member

- Retirement

- Migration to another country

- Unemployment due to layoff or company closure

- OFW repatriation from the host country

You have the option of withdrawing your funds for reasons other than those permitted by Pag-IBIG. However, if you choose to receive dividends after five years, you will only receive half of of the total dividend earned (if you chose to receive dividends after five years) or only your contributions (if you chose the annual dividend payout option).

- What will happen if I don’t claim my dividends?

After the five-year maturity period, unclaimed MP2 savings will continue to receive dividends (based on the dividend rates of the Pag-IBIG Regular Savings Program). It will no longer pay dividends after two years, and you should simply withdraw it.

- What happens if I decide to pre-terminate my account?

Account termination is possible with Pag-IBIG. The payments, however, vary based on the situation:

-

- You can withdraw your whole savings plus 50% of the dividends received if the cause for pre-termination is total incapacity, retirement, or any other reason specified by Pag-IBIG.

- However, if the reason for pre-termination is not stated in the Pag-IBIG MP2 Savings terms and conditions, you can withdraw your whole savings account without any dividends earned.

SOURCES:

- Modified Pag-IBIG 2 (MP2) Savings – Frequently Asked Questions (Pag-IBIG Fund Website)

- Moneymax Pag-IBIG MP2 Guide (Moneymax January 5, 2022)

- Pag-IBIG Fund members save record P52-B in last 10 months (Philippine News Agency December 1, 2021)

- Alamin: Mga dapat mong malaman sa pagbubukas ng Pag-IBIG MP2 Savings (Balita, January 14, 2022)

YOU MIGHT ALSO LIKE: ATTN Pag-IBIG Fund Members: Here’s How You Can Digitally Apply for Loan