Pag-IBIG Fund has heard our call!

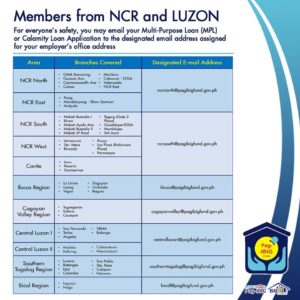

Amid the threat of pandemic novel coronavirus disease (COVID-19) in the country, the Pag-IBIG Fund has recently updated its loan application process. Those who do NOT have access to a printer can now digitally apply for Multi-Purpose Loan and Calamity Loan. This was recently announced via their Facebook Page.

WHO CAN APPLY?

- Actively contributing members “residing in areas included in the declaration of a state of calamity by the Office of the President or the local council,”

- Loan applicant must have at least 24 monthly membership savings and sufficient proof of income to qualify.

- For members with existing loans such as Pag-IBIG Fund Housing Loan, MPL and/or Calamity Loan, your payments must be updated.

HOW TO APPLY?

SIMPLIFIED VERSION

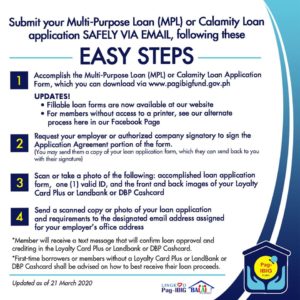

1. Download the forms for Multi-Purpose Loan and Calamity Loan . Fill out completely.

2. Save the filled-out form as PDF file.

3. Send the PDF file via email to your company Human Resources (HR) department, authorized company representative, or Fund Coordinator with other requirements below:

- One (1) valid ID of applicant

- Front and back images of applicant’s Loyalty Card Plus, or Landbank, UCPB or DBP cash card.

The company HR, authorized representative, or Fund Coordinator shall e-mail the following to the Pag-IBIG Fund email address designated for your area:

1. Applicant’s loan application and requirements

2. The filled-out ‘Employer Confirmation of STL Application’ bearing the applicant’s name. The form can be download via this link -> CLICK HERE.

NOTES:

- Qualified members may borrow up to 80% of their total Pag-IBIG Regular Savings. This consists of their monthly contributions, their employer’s contributions, and accumulated dividends earned.

- For members with outstanding Multi-Purpose and/or Calamity Loan, the amount of loan you will receive shall be the difference between the 80% of your total Pag-IBIG Regular Savings and the outstanding balance of your loan/s.

- Eligible borrowers must avail of the Calamity Loan within a period of 90 days from the declaration of a state of calamity.

- The loan is payable within 24 months and comes with the initial payment due on the third month after the loan release.

- Formally-employed members shall pay their loan amortization through a salary deduction arrangement with their employer.

- Self-employed individuals, overseas Filipino workers, and all other individual payors may pay their amortization at any Pag-IBIG Fund branches.

Never miss a SALE! Like and Follow us on Facebook, Twitter, Instagram and Google+ to check out other on-going promo, markdown madness and sale events.